Investors can integrate cyber posture into their ESG and risk due dilligence processes

Evaluate cyber posture as part of your due diligence and ESG scoring. Integrate cyber posture into smarter investment decisions.

As digital risk becomes a fundamental part of business value, investors can no longer afford to overlook cybersecurity. Whether you’re performing due diligence, managing a portfolio or reporting on ESG risk, cyber posture must become part of the equation.

How we help:

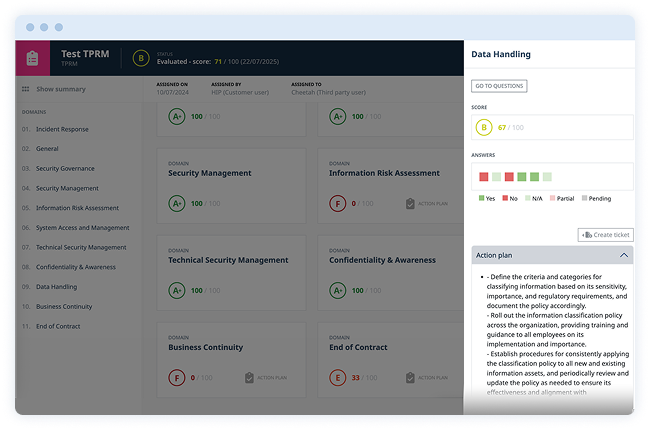

- Cyber risk scoring across target companies

- ESG alignment through continuous security metrics

- Alerts on incidents or posture deterioration

- Comparative views across industries or sectors

How Riskblade supports Investment teams:

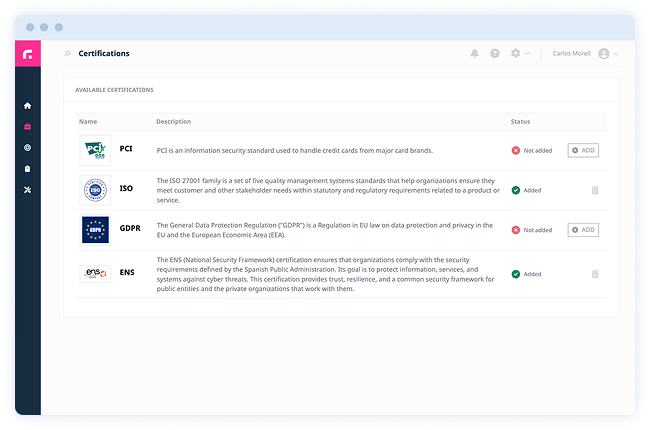

- Assess the cyber resilience of target companies, with automated scoring based on exposure, industry and third-party risk.

- Monitor posture evolution across your portfolio, identifying emerging risks before they materialize.

- Generate dashboards and reports that bridge technical cAlign with ESG standards, integrating cybersecurity into environmental and social impact frameworks.

- Receive alerts on critical incidents or scoring drops for early intervention.