Bridge the gap between cyber risk and insurance with tailored intelligence for insurers.

Riskblade helps both policyholders and insurers translate cyber posture into a measurable value. Understand and address cyber exposures to satisfy insurer requirements—streamline audits, reduce premiums, and improve claims readiness. Give insurers portfolio-level visibility: risk aggregation, dashboards, scoring trends and faster triage of mediated risk.

For Insureds

Understand your cyber exposure and take proactive measures to reduce your risk

Protecting your Business. Strengthening your Coverage.

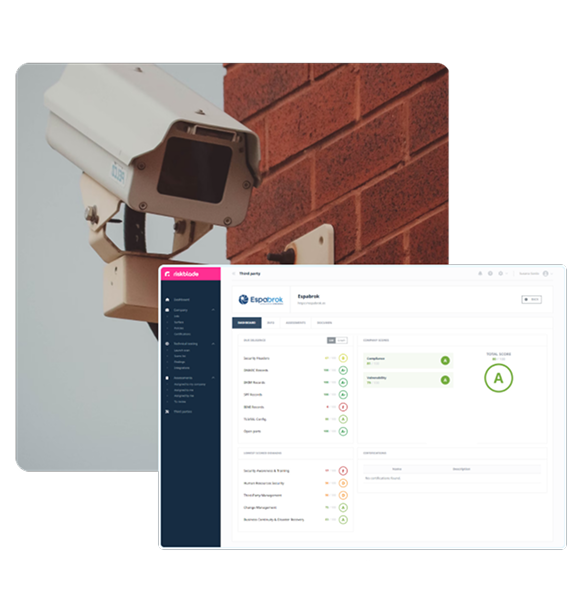

In today’s interconnected economy, third parties introduce significant cyber and compliance risks.

Insured organizations face increasing scrutiny from insurers and regulators to demonstrate proactive risk management — and a robust Third-Party Risk Management (TPRM) program is a critical part of that equation.

Why It Matters for Insureds

Enhance Insurabilit

Reduce Claims Exposure

Meet Compliance Demands

Strengthen Ecosystem Resilience

Defend Renewals & Audit

Key Capabilities of a Modern TPRM Solution Inventory & Assess Third Parties:

Monitor Continuously

Prioritize Actionable Insights

Report & Improve

Ready to take control of your third-party risk?

Portfolio Management

Assess, monitor and manage the cyber posture of your entire portfolio with Riskblade

Gain complete visibility into the cybersecurity performance of every company in your investment portfolio -from early steps start-ups to mature holdings. Riskblade enables investors to detect hidden vulnerabilities, benchmark risk levels and proactively mitigate exposure across the value chain. Ensure strategic alignment, regulatory compliance and digital resilience with continuous, data-driven insights tailored to your investment profile.